AI Agents 2025: From Chatbots to Autonomous Co‑Workers

Caiyman.ai Research Team

AI Solutions Architect

Welcome to the era of agentic AI. Less than a decade ago, chatbots could only spit out FAQ answers. Today’s agents draft code, browse the web, and schedule meetings without supervision. In this guide we unpack how the reasoning‑action loop works, why 2025 is the tipping point, and how your business can ride the wave.

What Exactly Is an AI Agent?

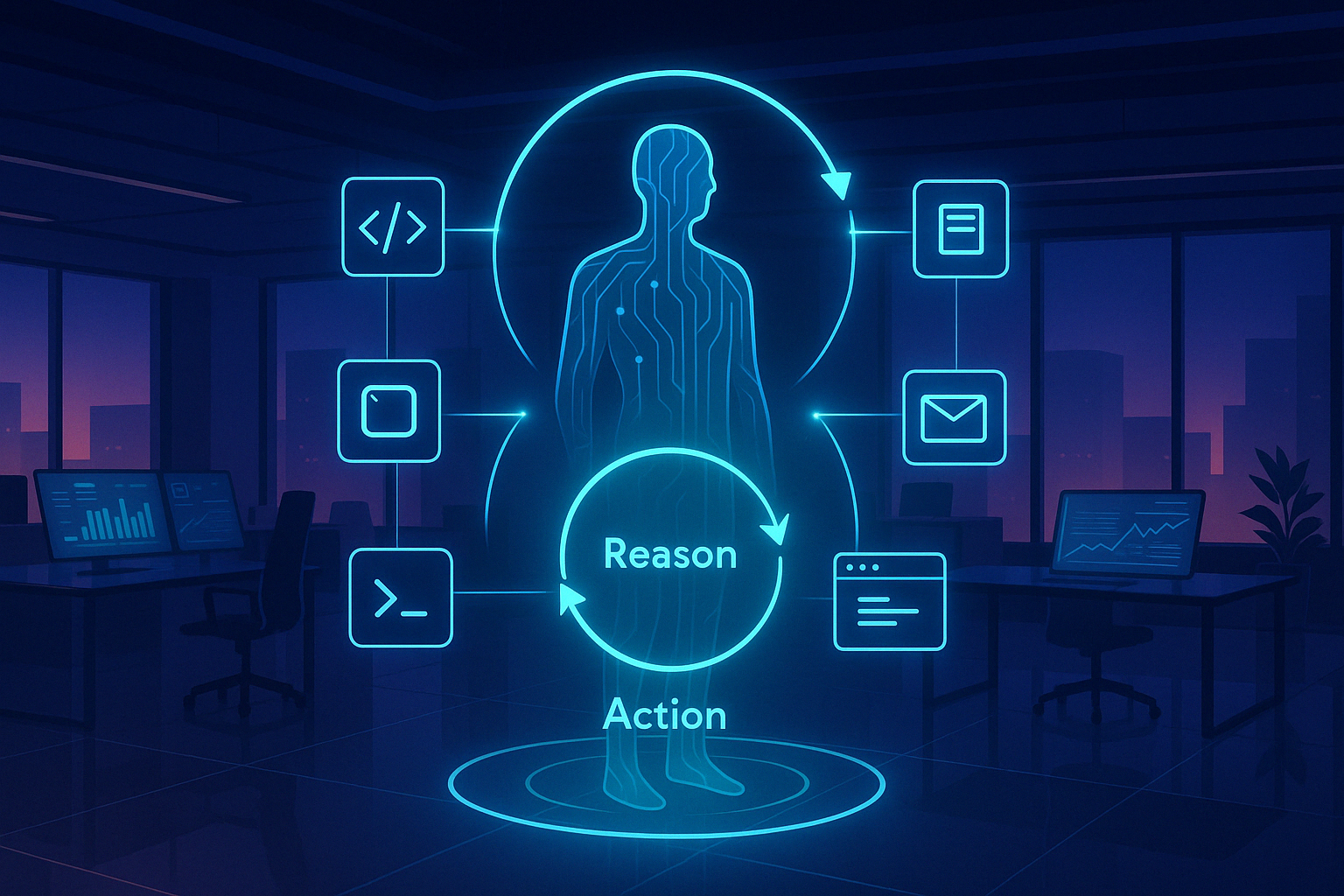

An AI agent plans, acts, observes, and re‑plans until the user’s goal is met. Instead of a single response, the model iterates through a loop:

- Plan → break the goal into executable steps.

- Act → call a tool such as a browser, API, or shell command.

- Observe → read the tool’s output and update memory.

- Repeat → continue until success criteria are satisfied.

The 2025 Tech Stack

Foundation Model

Large language or vision‑language models (LLMs/VLMs) supply chain‑of‑thought reasoning. Enterprises increasingly mix proprietary models with open‑source checkpoints for privacy and cost control.

Tooling Interface

OpenAI’s new Responses API bundles built‑in web search, file search, and computer‑use methods, removing complex glue code. For developers outside the OpenAI ecosystem, LangChain or Windsurf provide similar wrappers.

Memory & Long‑Term State

Vector databases like Supabase+MCP store embeddings of conversations, documents, and intermediate results so that an agent can pick up tasks days or weeks later.

Safety Guardrails

Rate limits, spend ceilings, and human‑in‑the‑loop approvals are essential. A policy engine checks every planned action before execution, preventing runaway loops.

Single vs Multi‑Agent Architectures

A single agent is simpler to build, but multi‑agent swarms scale better when tasks require domain specialization. A planner agent delegates subtasks to search, coding, or data‑analysis agents, then merges results.

Three High‑Impact Use Cases

- Customer Support —Tier‑0 agents answer 24/7, escalate nuanced tickets, and reduce average handle time by 60 %.

- Financial Research —Agents scrape SEC filings, compute key ratios, and send daily dashboards before markets open.

- Product QA —Browser automation agents click through user flows after every deployment, filing tickets with video evidence when something breaks.

Implementation Roadmap

- Define one narrow objective. “Summarize every Zoom call” is easier than “be my entire ops team.”

- Choose a framework. Start with OpenAI’s Agents SDK or Windsurf’s lightweight template.

- Add logs and guardrails immediately. You can relax constraints later but can’t recreate missing audit data.

- Pilot, measure, iterate. Track hallucination rate, tool‑success, average reasoning steps, and latency.

Challenges & Best Practices

Agents can rack up huge bills or enter infinite loops. Follow McKinsey’s trust checklist: transparent reasoning, clear user feedback channels, and a manual fallback path.

The Road Ahead

Research published in February shows agent time horizons doubling every seven months. By 2027, agents could autonomously finish projects that take human teams weeks. Companies that adopt early will own proprietary workflows and data that competitors can’t replicate overnight.

Ready to deploy? Contact Caiyman.ai for turnkey blueprints, custom integrations, and ongoing support.

Sources

Share this article

Related Articles

AI in Real Estate Finance: Market Analysis, Top Platforms & 2026 Implementation Strategies

Comprehensive analysis of AI adoption in real estate finance, featuring market projections, platform comparisons, and strategic implementation guidance for 2026.

AI Revolution in Real Estate 2025: How Technology is Driving $34B in Industry Transformation

Discover how artificial intelligence is revolutionizing real estate with $34 billion in projected efficiency gains, 37% task automation potential, and game-changing technologies reshaping every aspect of property operations in 2025.

AI in Commercial Real Estate 2025: How Smart Technology Is Reshaping Property Investment and Management

Discover how artificial intelligence is transforming commercial real estate in 2025, from predictive analytics to smart building management, driving 70-95% efficiency gains and creating new competitive advantages for property professionals.